The Case for Building In Commodity Markets

This piece was co-authored with Bala Chandrasekaran.

The word “commodity” has long carried a deeply negative connotation in the tech ecosystem. To call a product commoditized is to suggest it lacks innovation, differentiation, and – therefore – lasting value. But some of the largest businesses in the world have been built around selling undifferentiated products at massive scale. Saudi Aramco became the leading global crude oil producer by parlaying the uniquely favorable geologic characteristics of its oil fields into structurally lower extraction costs than any of its competitors. Martin Marietta acquired dozens of regional rock quarries across the U.S. to eliminate reliance on external suppliers, reduce transportation costs, and dominate the market for building materials. These may not seem like glamorous businesses, but they created durable enterprise value by creatively carving out sustainable positions at the bottom of the global cost curve for essential industrial raw materials.

While we acknowledge that low-margin business models and limited scope for technological innovation make commodity markets incredibly difficult to disrupt, we believe the knee-jerk tendency to dismiss them entirely is misguided. Macro trends like global trade rebalancing and national resilience imperatives are creating a strategic need to reshore production of critical resources, alleviating the pressure of competing with low-cost foreign suppliers. For ambitious founders undeterred by the complexity of these industries, we think there is a generational opportunity to build venture-scale businesses in markets that have not seen meaningful transformation for decades.

Types of Commodity Businesses

Before we dive into some specific opportunities we’re excited about, we think it’s useful to disambiguate our use of the (overloaded within tech) term “commodity” by distinguishing between two major types of commodity businesses:

“Input” Businesses

These are commodity businesses in the strictest sense: they offer products or services that are functionally identical to those sold by their competitors. While differentiation is possible through scale, reliability, or adjacent services, price is by far the primary decision-making criterion for end customers in such markets. As an example, all utility-scale power plants – regardless of whether they burn natural gas, use solar panels to charge grid-scale batteries, or operate light water reactors – ultimately sell the same exact product: electricity. In most cases, input businesses supply a relatively cheap raw material that serves as a vital precursor for more complex and expensive downstream products, such as the industrial-grade stainless steel that SpaceX uses to manufacture its rockets.

While input businesses seem conceptually simple to replicate due to their lack of product differentiation, in practice they tend to have remarkable staying power because of extreme economies of scale. Access to capital is the biggest barrier to entry, with challengers needing to invest substantial capex upfront to scale up production just to achieve cost-competitiveness with incumbents. As an example of the scale of capital needed, U.S. Steel spent more than $3B over 4 years to build out their Big River 2 steel mill, the largest single investment in Arkansas state history. Over time, first movers compound their advantage through accumulation of specialized technical knowledge, continued process optimization and infrastructure improvements, and – eventually – regulatory capture, evolving into highly important, value-accretive components within their respective value chains.

This doesn’t mean startups can’t build successful input businesses from scratch. Instead of creating a novel product, challengers must achieve a structurally differentiated cost advantage in a way incumbents aren’t able to replicate. There are a couple of ways they can do so:

Process innovation. Empirically, most new input businesses are created on the heels of a technological innovation that leads to a significant reduction in the per-unit cost of production, allowing them to enter the market at much lower rates. Since input businesses already operate on razor-thin margins, incumbents are unable to price-match without pursuing a wholesale redesign around the new process. This ultimately turns a moat (capitalization of infrastructure build-outs at scale) into a systematic disadvantage (capital impairment due to stranded assets).

As an example, in the 1960s, dominant steelmakers like U.S. Steel relied on the Bessemer Process, which required constructing large blast furnaces to produce molten iron that could then be converted into steel. Challengers like Nucor emerged by converting scrap steel in electricity-powered arc furnaces (EAF), a more modular design that could be adopted in much smaller mini-mills. This dramatically reduced the upfront capex needed to start producing and selling steel at market-clearing prices and allowed Nucor to steadily steal market share; today it’s the biggest producer of steel domestically.

Source: S&P Global. We find this to be a surprisingly common pattern in input business disruption: reduce costs by building smaller, more modular, and more linearly scalable variants of existing technologies, effectively converting capex into opex.

Identifying market distortions. Startups can sometimes create input businesses by targeting segments where regulatory or other forces introduce market inefficiencies. For example, U.S. mining companies have long been burdened by stringent environmental regulations and ESG requirements, which created an opportunity for foreign competitors to enter the market by leveraging cheaper labor and energy sources (e.g., coal-fired power plants). Today, China controls more than 70% of global lithium refining capacity despite owning less than 10% of global lithium reserves. A similar distortion exists in defense and aerospace, where U.S. export controls like ITAR limit the global competitiveness of American firms. In response, companies like Thales have developed ITAR-free products by avoiding U.S. components, enabling easier access to international markets.

Market distortions can also occur on the demand side whenever certain buyers prioritize factors other than cost—such as reliability or security. For instance, government agencies or hospital systems may be willing to pay a premium for electricity to ensure uninterrupted service, since profit motives aren't the primary concern. Alternatively, market distortions can arise even in price-sensitive markets when some subset of market participants don’t have access to low-cost options. Hawaiian residents, for example, pay ~40 cents per kilowatt-hour for electricity – over 60% higher than the U.S. average – due to the island’s isolation from the national grid and dependence on costly petroleum imports. This creates an opportunity for higher-cost, unproven technologies such as small-scale nuclear that might not be competitive elsewhere.

“Output” Businesses

By comparison, output businesses sell more complex products that can have significant variability in functionality or product experience across suppliers, but nevertheless still end up competing largely on price. These businesses do not start off looking like commodities, with first movers able to charge healthy margins by introducing something novel to the market. Over time, however, diffusion of technical knowledge, adoption of common standards, and maturation of the supply chain allows fast followers to introduce similar, cheaper versions of the incumbent product, effectively commoditizing the market.

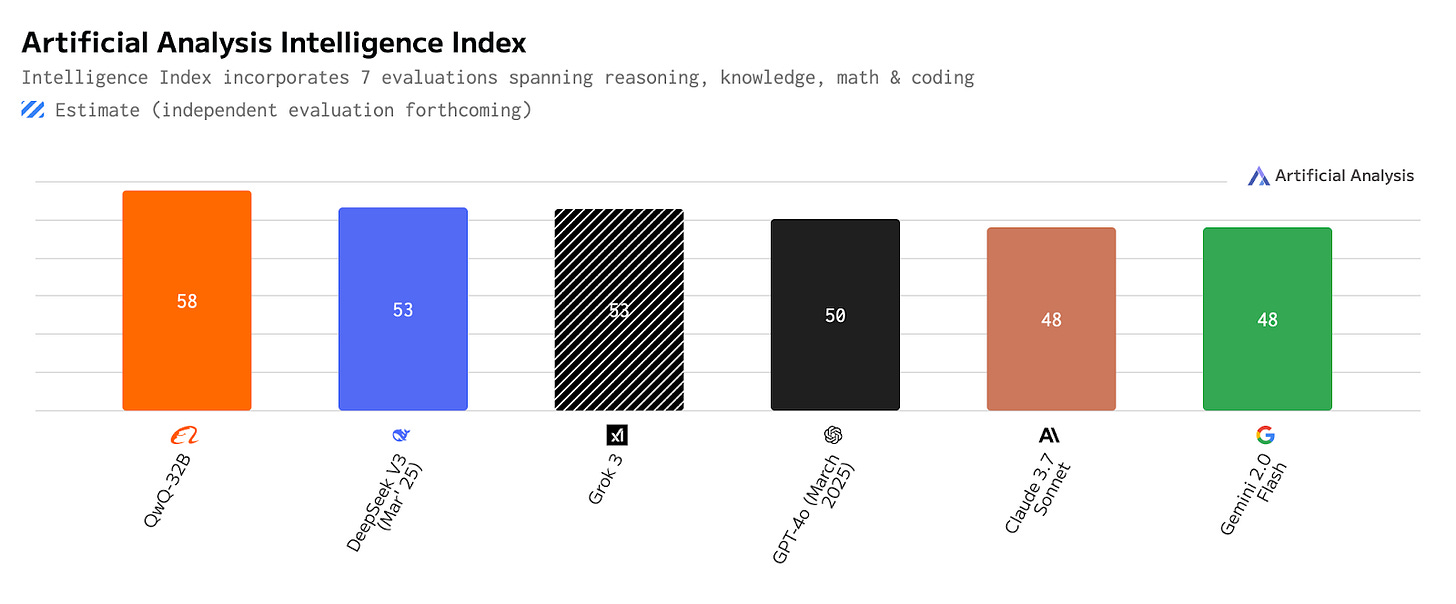

LLMs provide an illustrative case study here. When OpenAI released GPT-3 in June 2020, they were the only provider offering a hundred-billion-parameter-scale transformer model via API, giving them a temporary monopoly on the nascent enterprise LLM market. Today, however, at least six different providers – OpenAI, Anthropic, Google, Grok, Alibaba, and DeepSeek – host APIs with similar levels of frontier model performance.

Although customers do tend to favor certain providers for some use cases, such as Claude for code, adoption of universal standards like the OpenAI completions API and the MCP protocol have rendered the various LLM providers functionally interchangeable, enabling enterprises to adjust purchasing decisions in real-time based on per-token cost for a given intelligence level. Meanwhile, the fungibility of resources like open-source research, compute, and top AI talent across providers has made it nearly impossible to achieve defensible technical differentiation at the model level (with the ultra-secretive SSI trying to be the exception). Infrastructure improvements likely played a role in the ~80% / year decrease in GPT-4 pricing since launch, but OpenAI’s API business has almost certainly also experienced some level of margin compression in the face of heavy competition from a wave of copycat output businesses.

Unlike input businesses, where success is driven by process superiority, output businesses ultimately have to rely on strategic counter-positioning, capital efficiency, and sometimes government backing in order to generate durable revenue streams. While the category-creator ends up accruing most of the value in the majority of new markets (e.g. OpenAI’s ChatGPT business is much stickier than its APIs), we believe there are a few market trends that can signal opportunities for founders to build meaningfully large output businesses:

Need for redundancy/multi-homing. Empirically, we find that enterprise markets, particularly in critical infrastructure, rarely ever evolve into true monopolies because buyers demand redundancy to mitigate risk, avoid vendor lock-in, and gain leverage in contract negotiations. This creates structural opportunities for challengers to scale even when they lag behind a clear market leader. Just as GCP and Azure built meaningfully large cloud businesses despite AWS beating them to market by several years, we hypothesize that we will eventually see strong market pull for competing providers to SpaceX, such as Blue Origin and Rocket Lab, so that businesses dependent on space launch capabilities can ensure resilience and strategic flexibility.

Modularization of the value chain. Clayton Christensen theorized that as industries mature and performance overshoots customer needs, once-integrated value chains eventually begin to unbundle—breaking into specialized layers with clean integration points in an effort to lower end-to-end production costs. This unlocks opportunities for focused, capital-efficient businesses to sell competitive products without needing to build out the whole stack. For example, in semiconductors, Intel’s vertically integrated model of designing and fabricating its own chips was once dominant, but over time the market unbundled: ASML emerged as the lithography tooling king, TSMC became the leading third-party fab, and AMD focused purely on chip design. While some of these businesses were incredibly defensible and accrued monopoly profits (e.g. TSMC with leading-edge nodes and Nvidia with GPUs), modularization also created opportunities for new entrants to commoditize certain layers, such as GlobalFoundries with mature process nodes and SK Hynix with DRAM chips.

An interesting observation here is that early winners in new consumer markets tend to be significantly more resistant to modularization than in enterprise markets, largely due to the effectively unbounded willingness to pay for a premium product among the top end of users. For instance, despite the influx of cheap Chinese smartphones and electric vehicles, Apple and Tesla have both been able to build defensible high-margin consumer businesses on the strength of their superior user experience and premium brand. By point of comparison, Intel’s stubborn insistence on vertical integration despite competition from more efficient modularized players eroded more than $400B of market cap.

Preference for regional suppliers. In some cases, challengers can utilize nationalism, security concerns, or other cultural reasons as a basis for displacing incumbents within their local markets before expanding outwards. In the 1960s, U.S. firms dominated the commercial airliner market, with Boeing – the first mover – rapidly compounding its way towards monopoly status on the back of its innovative 737 and 747 designs. Airbus was founded in 1970 as a consortium of sub-scale French, German, Spanish, and British aerospace companies in an effort to collectively marshal European resources and technology towards building a viable challenger to Boeing. Through extensive government support including R&D subsidies from E.U. member states, the ability to sell across the entire European market, and a contentious practice known as repayable launch investments (government loans that were automatically forgiven if a product launch failed), Airbus was able to gradually steal share, delivering twice as many commercial aircraft as Boeing in 2024; now we’re seeing Comac attempt to repeat the same playbook within China today.

Source: Medium. Given the recent fractioning of U.S.-E.U. relations, companies focused on selling into European subsets of critical markets such as defense (e.g. Helsing) or generative AI (e.g. Mistral) will likely end up building viable output businesses despite early market leadership from U.S. companies like Anduril and OpenAI. The key for such businesses is to continuously invest in technological and operational innovation in order to maintain competitiveness in the broader market. The rapid decline of European auto OEMs as EV adoption accelerates serves as a cautionary tale of what happens when a regional champion becomes overly reliant on directed industrial policy to compensate for poor unit economics and a stagnating product.

Opportunities We’re Excited About

Below, we outline three specific commodity markets that we think are particularly ripe for disruption today: renewable energy supply chains, small modular reactors, and drone manufacturing.

It’s time to reshore production of key components in the renewables supply chain.

Energy abundance is one of the single biggest drivers of economic growth across the world, and increasing generation capacity from renewable sources like wind and solar has quickly become our strongest lever for reducing the cost of energy. Unfortunately, due to systematic underinvestment across the supply chain, the U.S. has become completely dependent on global trade partners to deploy more renewable capacity to the grid. Imports accounted for ~88% of all U.S, solar panel shipments in 2022, and imports from China alone accounted for ~70% of all lithium-ion batteries deployed domestically in 2023. With geopolitical tensions making continued reliance on cheap foreign imports untenable, we think there’s an opportunity to build scaled input businesses by investing in domestic production of critical raw materials needed to manufacture solar and storage technologies.

In solar, the most interesting target is likely polysilicon, the base input needed to manufacture PV cells. A staggering 93% of the total global polysilicon supply is currently sourced from China, up from 77% in 2020. There are only 2 operational sites capable of producing polysilicon at commercial scale in the U.S. today, but even when accounting for import tariffs and IRA incentives, producing polysilicon domestically is still 5x as expensive as in China because of their significantly lower cost of power (electricity accounts for 40% of the unit cost). With the Trump admin simultaneously relaxing domestic environmental regulations and pursuing aggressive tariff step-ups against China, there’s a temporary window for a net-new supplier to seize market share, perhaps by investing in cheap co-located power generation such as on-site hydrogen or nuclear. There may also be an opportunity for process innovation. More than 85% of polysilicon production today, including both existing U.S. facilities, rely on the Siemens Process, which produces extremely high purity silicon but is also expensive and energy-intensive. Some facilities are experimenting with an alternate process based on fluidized bed reactor (FBR) technology, which can theoretically operate continuously with much higher energy efficiency and thereby drive down unit costs. Scaling a cost-competitive polysilicon site from scratch around FBR technology will require clearing an immense execution bar – incumbent REC Silicon abandoned its own efforts to do so at its Moses Lake site in Washington after struggling to meet required purity levels – but is a worthwhile challenge for someone looking to apply the Elon algorithm to a critical growing industry.

For batteries, we see similar dynamics at play in the market for critical minerals such as graphite. A lot of attention has been cast on the problem of securing access to raw mineral deposits through control of key mining assets, but there is a potentially much more pressing risk in the form of our reliance on foreign sources for mineral processing. Currently, China controls 95% of global refining capacity for manganese, as well as 70% for graphite, 67% for lithium, and 63% for nickel. While the shift in cathode composition from NMC to LFP has made securing access to some of these minerals less necessary, virtually every battery anode in existence consists entirely of graphite, one of the main reasons why U.S. graphite demand is projected to 7x over the next 10 years. Whether by investing in more energy-efficient and therefore cost-competitive technologies for synthetic graphite generation, or by iterating on known low-cost natural graphite refining processes so they can be scaled within the parameters of domestic environmental regulations, we think that process innovation aimed towards increasing U.S. share of global graphite production is a promising direction.

Beyond polysilicon and graphite, there are undoubtedly many other bottlenecks in adjacent energy supply chains that could make good targets for venture-scale businesses, such as rare earth refining, uranium enrichment, and electrical transformers to name a few.

Robust demand for off-grid energy can finally unlock small-scale nuclear.

Energy is not only the most ubiquitous commodity, it is also the foundational input for all industrial activity. Yet virtually all energy infrastructure investment has flowed into utility-scale providers operating within the centralized grid, a market that is heavily regulated, notably slow-moving, and highly saturated, and therefore nearly impossible to disrupt. Meanwhile, off-grid energy markets remain fragmented and underserved, with sectors like mining, defense, data infrastructure, and rural electrification willing to pay significant premiums – up to 16x as much as on-grid rates – for decentralized, reliable, and high-density power generation.

We think Small Modular Reactors (SMRs) are uniquely positioned to take advantage of this market distortion. SMRs, or mass-manufactured and transportable nuclear reactors that can generate continuous baseload power in any setting, function as the ultimate input: factory-built, inherently self-sufficient, and arbitrarily scalable “energy-in-a-box.” Unlike diesel generators and solar-plus-storage systems, SMRs offer superior power density with minimal land use, safety concerns, and logistical overhead, making them well-suited for remote, high-demand, or mission-critical environments. And unlike utility-scale power plants and wind/solar farms, SMRs can deploy on federal or private land independent of geographic constraints, thereby bypassing the lengthy interconnect queues and regulatory paralysis that plague the grid.

Although SMRs haven’t been commercialized to date, the recent AI-driven explosion in compute demand coupled with a surge of sovereign interest in operational energy resilience due to global instability are catalyzing renewed activity in this direction. The SMR market also exhibits textbook oligopolistic dynamics: extreme capital intensity, prolonged regulatory cycles, and deep technical moats naturally limit the number of viable players. Given the effectively unbounded demand for off-grid energy and the narrow pipeline of deployable supply, we believe successful SMR businesses will find themselves in the enviable position of selling a commodity at healthy yet defensible margins.

The U.S. needs to invest in a domestic drone champion.

Drone technology is rapidly evolving from a niche innovation into critical industrial infrastructure. As cost-performance improves and adoption expands across sectors like defense, logistics, law enforcement, and energy, customers are seeking mass-deployable general-purpose fleets rather than bespoke solutions, with affordability increasingly driving purchasing behavior. Simultaneously, breakthroughs in autonomy, AI navigation, and battery density – powered by onboard compute platforms like NVIDIA Jetson – are modularizing core technology layers, shifting the focus from initial technical differentiation to standardization. Given these trends, we expect the category to follow the familiar output business arc: pricing pressure increases as functionality converges across suppliers, and the competitive edge shifts to those who can manufacture at scale, integrate deeply with existing software ecosystems, and ruthlessly optimize costs.

Despite this commoditization of the market, however, the U.S. still lacks a dominant, domestically-owned drone manufacturer capable of meeting demand across industries. This urgency is being amplified by regulatory and geopolitical tailwinds. DJI currently controls 70% of the global drone market, but national security concerns are pushing restrictions on Chinese imports and shifting procurement pipelines towards U.S.-based suppliers. This is especially true in use cases like border security and infrastructure monitoring, where domestic sourcing is not only incentivized but often required. Like cloud and LLMs, drones are on track to become a critical enterprise commodity, and the need for a regional champion should lower the barrier for new entrants to compete.

Parting Thoughts

We believe that commodity businesses will lay the foundation of the next industrial renaissance. As inputs and outputs alike move toward standardization and scale, the real opportunity lies not in avoiding commoditization, but in mastering it. Founders who understand how and where value accrues – through process innovation, policy shifts, or capital leverage – can build businesses that are not just defensible but indispensable.

If you’re currently thinking about or are already building a commodity business in one of these or related areas, we’d love to hear from you; please give us a shout at shreyan@eladgil.com or bala@altcap.com.

Special thank you to Paavan Gami, Michelle Fang, Sid Vashist, Sid Venkateswaran, and Varun Gupta for their feedback on early drafts of this piece.